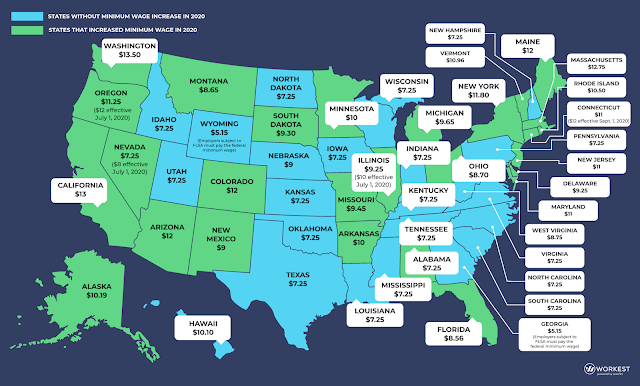

Map Showing How Minimum Wage Rates Differ from State to State

How Many American Workers Are Protected by The Fair Labor Standards Act?

Does the Fair Labor Standards Act Apply to Small Companies?

The below is from the U.S. Department of Labor's overtime_complianceguide.pdf (dol.gov):

Generally, the FLSA applies to employees of enterprises that have an annual gross volume of sales made or business done totaling $500,000 or more, and to employees individually covered by the law because they are engaged in interstate commerce or in the production of goods for commerce. In addition, employees of certain entities are covered by the FLSA regardless of the amount of gross volume of sales or business done. These entities include: hospitals; businesses providing medical or nursing care for residents; schools (whether operated for profit or not-for-profit); and public agencies...

So, the issue is not necessarily the number of employees but, rather the productivity of the company (>$500k in revenue) or the nature of the business (interstate commerce, engaged in health care, etc.).

Further, the FLSA is rife with other exceptions, so it is best to consult counsel if you have questions concerning its applicability to any given employer.

Companies that do not fall within the FLSA guidelines are not governed by the law. That said, states can establish their own laws, so long as that they do not provide less protection than does the FLSA.

What Does the Fair Labor Standards Act Cover?

Perhaps the most notable things governed by the FLSA are overtime and minimum wage. This Article addresses minimum wage-related issues. More specifically, a state by state survey of minimum wage laws.

How Many States Allow Employers to Pay Less Than the Federal Minimum Wage?

Minimum wages in the United States are governed by the Fair Labor Standards Act ("FLSA"). If a company does not fall within the purview of FLSA, it can pay less than the FLSA minimum wage, unless there is a state law that says otherwise.

Two states, Georgia and Wyoming, in fact do have state laws that authorize employers not governed by FLSA to pay less than the FLSA minimum wage. In both states, such employers can start workers at $5.15 per hour.

How Many States Have Minimum Wage Laws That Are Identical to the $7.25 Established by Federal Law?

As of January 1, 2021, 14 states have laws that require employers to pay the $7.25 per hour required by the FLSA (see Chart, below).

How Many States Will be Raising Their Minimum Wage in 2021?

By our count, it appears as though 25 states will be raising their minimum wage rate in 2021.

How Many States Require Employers to Pay More Than the Federal Minimum Wage of $7.25 Per Hour?

Minimum wages in the United States are governed by the Fair Labor Standards Act ("FLSA"). The FLSA provides a minimum threshold for hourly pay rates; however, states are permitted to require higher thresholds if they wish to do so.

29 States, along with Washington DC, Guam and the Virgin Islands in fact have state laws that require employers to pay more than $7.25 to employees.

How Many States Have No Minimum Wage Rate, and What Does That Mean?

Minimum wages in the United States are governed by the Fair Labor Standards Act ("FLSA"). If a company does not fall within the purview of FLSA, it can pay less than the FLSA minimum wage, unless there is a state law that says otherwise.

4 states have no minimum wage law at all - Alabama, Louisiana, Mississippi and Tennessee, which means that companies that are not governed by FLSA can pay employees whatever minimum wage they want!

Which 5 States/Territories Have the Highest Minimum Wage Rate?

1. Washington, D.C. ($15.00)

2. California ($14.00)

3. Washington ($13.69)

4. Massachusetts ($13.50)

5. Connecticut ($13.00)

You May Also Like:

Here is a State by State Survey of Minimum Wage Rates

Sources: https://www.dol.gov/agencies/whd/minimum-wage/state & this article from USA Facts.

|

State

by State Minimum Wage Rates (as of March 24, 2021) |

|

|

State |

Minimum wage |

|

Alabama |

No state minimum wage law |

|

Alaska |

$10.34 |

|

Arizona |

$12.15 |

|

Arkansas |

$11.00 |

|

California |

$13.00 for employers with 25 or fewer employees. Will

increase to $14.00 per hour on January 1, 2022 and $15 per hour on January 1,

2023; $14.00 for employers with more than 25 employees (will

increase to $15.00 per hour on January 1, 2022) |

|

Colorado |

$12.32 |

|

Connecticut |

$12.00 |

|

Delaware |

$9.25 |

|

Florida |

$8.65 |

|

Georgia |

$5.15 |

|

Hawaii |

$10.10 |

|

Idaho |

$7.25 |

|

Illinois |

$11.00. Will increase by $1 on January 1 of each

year until reaching $15 per hour in 2025 |

|

Indiana |

$7.25 |

|

Iowa |

$7.25 |

|

Kansas |

$7.25 |

|

Kentucky |

$7.25 |

|

Louisiana |

No state minimum wage

law |

|

Maine |

$12.15 |

|

Maryland |

$11.60 per hour for

employers with fewer than 15 employees; $11.75 per hour for employers with 15

or more employees |

|

Massachusetts |

$13.50 |

|

Michigan |

$9.65 per hour |

|

Minnesota |

$10.08 per hour |

|

Mississippi |

No state minimum wage

law |

|

Missouri |

$10.30 per hour |

|

Montana |

$8.75 per hour for

businesses with gross annual sales of more than |

|

Nebraska |

$9.00 per hour for employers with more than three

employees |

|

Nevada |

$8.00 per hour for

employees qualifying for health benefits and $9.00 for employees without

health benefits. Both tiers will increase by 75 cents on July 1 of each year

until reaching $11 per hour and $12 per hour in 2024 |

|

New Hampshire |

$7.25 per hour |

|

New Jersey |

$12.00. Will

increase by $1 on January 1 of each year until reaching $15 per hour in 2025 |

|

New Mexico |

$10.50 per hour |

|

New York |

$12.50 statewide; $15 per hour in New York City, Long Island and Westchester County |

|

North Carolina |

$7.25 |

|

North Dakota |

$7.25 |

|

Ohio |

$8.80 |

|

Oklahoma |

$7.25 per hour for

employers of ten or more full time employees at any one location and

employers with annual gross sales over $100,000; $2 per hour for all other

employers |

|

Oregon |

$12.00 per hour statewide standard; $13.25 per hour in the

urban area around Portland; $11.50 per hour in non-urban parts of the state |

|

Pennsylvania |

$7.25 |

|

Rhode Island |

$11.50 |

|

South Carolina |

No state minimum wage

law |

|

South Dakota |

$9.45 |

|

Tennessee |

No state minimum wage

law |

|

Texas |

$7.25 |

|

Utah |

$7.25 |

|

Vermont |

$11.75 per hour. Will increase to $12.55 per hour in 2022

with future increases tied to inflation |

|

Virginia |

$7.25 |

|

Washington |

$13.69 per hour statewide. Will change on January 1 of

each year based on the federal Consumer Price Index; $16.69 per hour in

Seattle; $16.57 per hour in SeaTac |

|

West Virginia |

$8.75 |

|

Wisconsin |

$7.25 |

|

Wyoming |

$5.15 |

|

District of Columbia |

$15.00 |

|

Guam |

$8.75 |

|

Puerto Rico |

$7.25 |

|

U.S. Virgin Islands |

$10.50 |

HERE

ARE SOME OTHER ARTICLES YOU MAY FIND WORTHWHILE:

The

16 States (Plus D.C.) That Have Mandatory Paid Sick Leave Policies

Here

Are Some Major Cities That Have Mandatory Paid Sick Leave Laws for Employees of

Private Employers

WHAT 34 STATES DO NOT HAVE ANY PAID SICK LEAVE LAWS FOR PRIVATE EMPLOYERS?

Pennsylvania Overtime Lawyers Explain the Basic Rules -

Exempt or Non-Exempt